By Jonathan Oh, CEO – SupplyCart / ADAM-Procure

When a company like Google talks about procurement, it isn’t talking about “three quotes and a PO.”

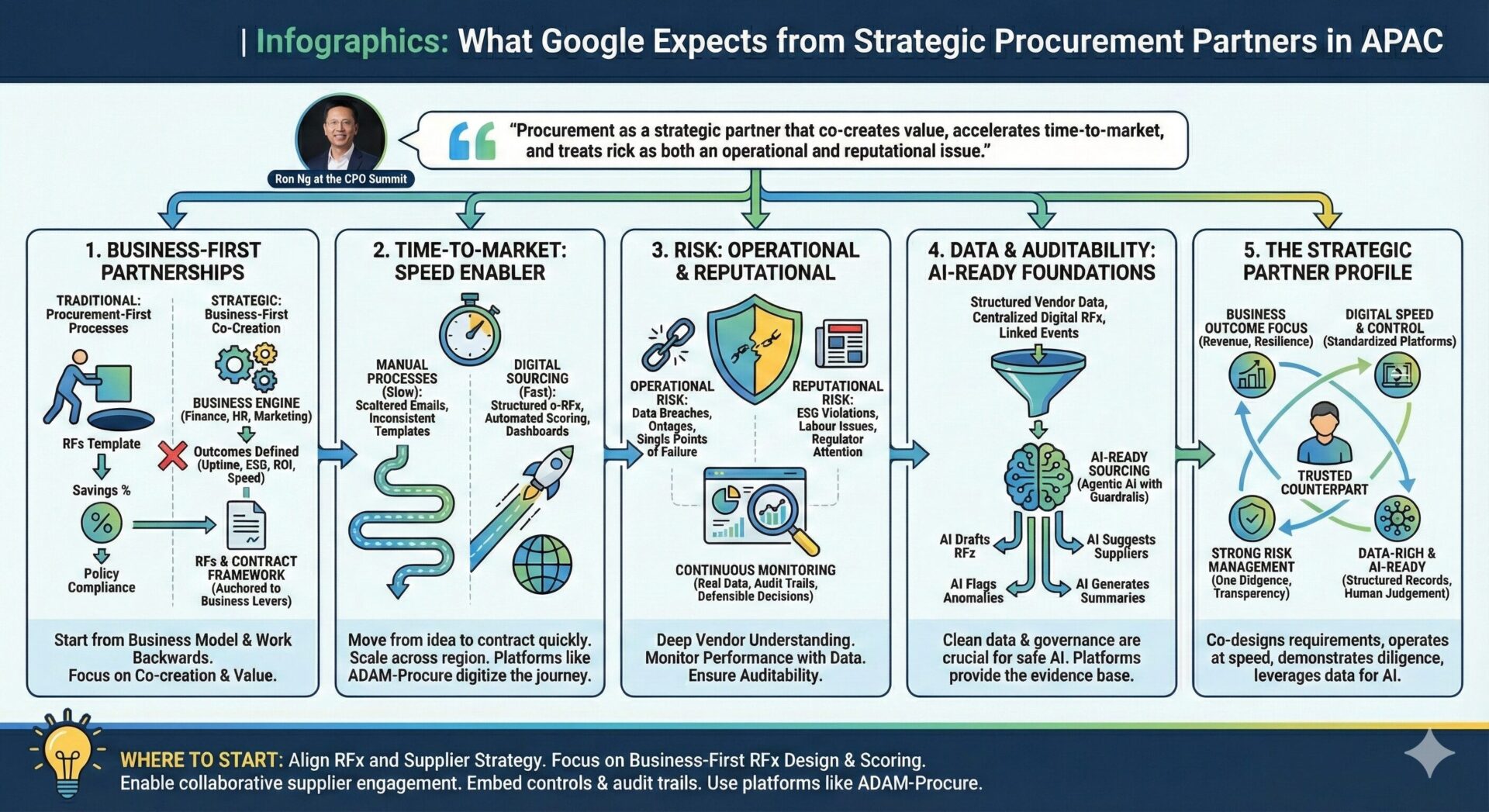

In his keynote at the 8th Annual CPO Summit in Kuala Lumpur, Ron Ng, APAC Head of Procurement for Google Asia Pacific, framed a very different expectation: procurement as a strategic partner that co-creates value with the business, accelerates time-to-market end-to-end, and manages risk as both an operational and reputational concern.

For CPOs and procurement leaders across APAC, the message is clear. To be taken seriously by global digital players, and by their own boards, procurement must move beyond transactional excellence and become a business-first, data-driven, AI-ready function.

This article unpacks what that actually means in practice, and how procurement teams can align.

- Business-first partnerships, not procurement-first processes

Global digital companies start from the business model and work backwards. Procurement is expected to understand how the organisation makes money, what drives growth and retention, and where risk really lives.

In a traditional setup, the business unit writes a brief, procurement “runs the process,” and everyone is asked to squeeze their needs into a standard RFx template. Success is reported as percentage savings and policy compliance, even if the process slowed things down or missed opportunities to improve outcomes.

The co-creation model flips this sequence. The starting point is the business engine, not the sourcing template.

Take payroll as an example. For a company like Google, the priority is not simply the unit cost per payslip. Accuracy across markets, regulatory compliance, and employee experience are often far more important. In marketing, the real levers are speed to launch, creative quality, and the ability to reallocate budget quickly when a campaign under- or over-performs. Pure rate reduction means very little if it undermines those goals.

A business-first procurement team sits down with stakeholders—finance, HR, marketing, IT—and defines success in those terms. Uptime, SLA adherence, data security, employee NPS, campaign ROI, ESG outcomes: these become part of the brief. Strategic suppliers are then engaged as potential co-creators who can bring new ideas, automation and data capabilities, not just a sharper quote.

Only after this alignment does the RFx and contract framework take shape. Instead of generic templates, requirements and scoring criteria are anchored to the business levers that actually matter. This is exactly the spirit of the CPO Summit agenda when it emphasised stronger business partnerships and a reinvention of procurement’s value proposition.

For suppliers, the implication is clear. When dealing with a “Google-style” buyer, they are judged not just on price, but on their ability to plug into the client’s business model and help deliver outcomes.

- Time-to-market: procurement as a speed enabler

In digital businesses, speed is not a nice add-on; it is a competitive weapon. New products, market entries and campaign pivots are often measured in weeks or days, not quarters. That reality puts procurement under a different kind of pressure: can you support this rhythm without sacrificing governance?

The critical questions become: how quickly can you move from idea to shortlist to contract? How fast can you onboard a new supplier for a pilot without tying the business in knots? Once a pilot works in one market, can you scale it across the region without starting from zero each time?

The FMM Supply Chain Webinar that SupplyCart supported broke this down into three practical capabilities: robust supplier management, digital sourcing, and disciplined contracts and performance. Digital sourcing is often where the speed uplift comes from. Instead of scattered emails and inconsistent templates, structured e-RFx flows channel everything through a single process. Vendor submissions are secure, time-stamped and directly comparable. Automated scoring and dashboards help teams evaluate, shortlist and iterate far faster than manual spreadsheets ever could.

In some transformations, end-to-end procurement cycle times have been reduced by as much as 70%, while actually improving transparency and trust. Vendors value seeing uniform rules, clear deadlines and consistent communication. For a buyer like Google, that is simply the baseline: procurement should shorten the distance between business intent and supplier execution, not lengthen it.

Platforms such as ADAM-Procure are designed with this reality in mind, digitising the journey from vendor registration through RFx to PR→PO with governance built into the flow rather than bolted on afterwards.

- Risk is both operational and reputational

Tech companies operate under intense public and regulatory scrutiny. When a supplier fails, the consequences are rarely contained to a single delayed delivery. Data breaches, labour issues, environmental violations or outages can quickly escalate into front-page stories and regulator attention.

This dual character of risk—operational and reputational—is increasingly visible in how procurement is regulated and benchmarked in markets like Malaysia. Policy directions such as the Malaysia Procurement Bill 2025 emphasise open competition, digital transparency and vendor accountability. They call for structured review panels, appeals mechanisms and standardised practices across the public sector. Conversations at CPO2025 echoed the same theme: procurement is expected to deliver on ESG, resilience and compliance as part of its core remit.

From the perspective of a global tech buyer, a strategic procurement partner in APAC must therefore demonstrate three things.

First, they need a deep understanding of their vendor network. It should be clear which suppliers are genuinely critical, where the single points of failure are, which vendors have weaker ESG or financial profiles, and where concentration risk is emerging.

Second, they must monitor performance and risk using real data, not just initial paperwork. On-time delivery, quality incidents, response times, cyber posture, audit findings and sustainability credentials all feed into the risk picture. A vendor that was low-risk at contract signature may look very different two years later if performance is deteriorating or their risk profile has changed.

Third, they must be able to prove that sourcing and contracting decisions are defensible. When regulators, auditors or internal stakeholders ask “why this supplier?”, it is no longer sufficient to point to a folder of emails. Decisions need to be backed by structured scoring, documented trade-offs, and complete audit trails.

Digital platforms like ADAM-Procure are built with this in mind. They don’t only record which supplier was selected; they show how and why: the criteria used, the weightings, the individual evaluations, the approval path, and the history of performance since. For global tech buyers, that level of traceability is part of how they manage reputational risk in complex markets, not a nice-to-have feature.

- Data and auditability: the foundations for AI-ready sourcing

Organisations such as Google are already experimenting with AI across back-office and procurement workflows. But the more advanced the conversation, the more one principle comes up: AI is only as good as the data and governance it sits on.

In practice, that means a strategic procurement partner is expected to have clean, structured vendor data rather than unsearchable free text; centralised digital RFx records with machine-readable scoring and outcomes; and clear links between events, contracts and performance data. With these foundations in place, agentic AI can start to do useful, safe work.

For example, AI can draft RFx documents aligned to standard criteria and past best practice instead of starting from a blank page. It can suggest suppliers based on patterns in performance, risk and ESG history rather than simple category tags. It can flag anomalies in bids, unusual pricing patterns or deviations in contract performance that warrant human attention. It can generate first-pass evaluations and summaries that save time for evaluators, while leaving final judgement in human hands.

Without structured data and auditability, AI pilots become risky and hard to trust, especially in organisations that are already under scrutiny. The risk of amplifying bias or making opaque decisions is simply too high.

Here, solutions like ADAM-Procure act as AI enablers. By enforcing structure in vendor records, RFx events and approval flows, they create the digital evidence base that allows agentic AI to operate within clear guardrails instead of improvising around gaps.

- What a “strategic procurement partner” looks like to Google-style buyers

When you pull these threads together, a clear profile emerges.

To a global tech company, a strategic procurement partner in APAC is one that starts with business outcomes and co-designs requirements, criteria and KPIs with stakeholders. It frames sourcing decisions in terms of revenue impact, resilience and experience, not just unit cost. It treats key suppliers as innovation partners and is willing to share enough transparency for genuine collaboration on ESG, risk and performance.

It also operates at digital speed without losing control. Processes are standardised and supported by platforms; RFx and contracting timelines are compressed; pilots and roll-outs can be executed quickly across markets because the underlying templates and workflows are reusable.

On the risk side, it can demonstrate strong due diligence, ongoing monitoring and early-warning mechanisms for both operational and reputational issues. When challenged, it can show that evaluations were fair and transparent.

Finally, it is data-rich and AI-ready. Records are structured enough to feed advanced analytics and AI agents, and there is a clear understanding that AI augments human judgement rather than bypassing governance.

Organisations that reach this level don’t just negotiate sharper deals. They become trusted counterparts that global digital players want to work with when they plan to grow in APAC.

Where to start: align RFx and supplier strategy

For many teams, the biggest gap between aspiration and reality sits in the RFx and supplier co-creation layer. Criteria live in offline templates, scoring is inconsistent or hard to reconstruct, and neither stakeholders nor suppliers have a clear view of how decisions were reached.

Addressing this layer is often the fastest way to prove a more business-first mindset to internal stakeholders and demonstrate maturity to global partners. It also creates the structured data foundation needed for any serious AI initiative later on.

This is where platforms like SupplyCart’s ADAM-Procure are focused: enabling business-first RFx design and scoring, supporting collaborative supplier engagement, and embedding the controls and audit trails that global tech buyers expect—while integrating all of that into vendor management and P2P processes.

The expectations set out on stage in Kuala Lumpur are high, but they are not theoretical. They describe how leading organisations already work with their procurement partners today. The opportunity for APAC teams is to close that gap deliberately, one well-designed process and one well-governed RFx at a time.

CTA: See a demo of business-first RFx scoring & supplier co-creation

If your organisation is rethinking how it shows up to strategic partners, and how it partners with its own business units, your RFx and supplier collaboration model is the logical starting point.

A focused demonstration can show:

- How criteria and scoring can be aligned to real business outcomes.

- How vendor masking, approval chains, and audit trails protect both you and your suppliers.

How co-creation with stakeholders and vendors can be embedded directly into the sourcing workflow.

👉 If you’d like to schedule a session, get in touch and we’ll find a time that works.

https://adam-procure.com/contact-us/

The shift is already underway. Malaysian CPOs are stepping into a bigger mandate, one built on visibility, accountability, and value creation. With the right foundations in place, procurement doesn’t just protect the bottom line; it helps grow the business.

See ADAM in action.

Get started and our friendly team will take care of the rest.

Explore how ADAM can transform your vendor management strategy today.