By Jonathan Oh, CEO – SupplyCart / ADAM-Procure

A Country Playbook for CPOs, CFOs & Procurement Leaders.

By 2026, Malaysian procurement will operate under a very different set of expectations than most teams were designed for.

Regulators are pushing hard on transparency and fair competition. Boards are asking tougher questions about risk and ESG. Business units want speed and agility, not slow, paper-heavy workflows. And suppliers themselves are looking for buyers who can partner and grow with them, not just enforce rules and squeeze margins.

This playbook pulls together what’s emerging from the CPO Summit, the FMM Supply Chain Webinar, and Malaysia’s policy direction into a simple roadmap built around four priorities:

- Make risk management part of daily operations

- Elevate supplier ESG from compliance to education

- Move from activity to KPI-driven maturity

- Use technology to deliver transparency and trust

It’s written with Malaysian CPOs, CFOs, COOs and senior procurement leaders in mind—people who need something practical and country-specific, not just theory.

Priority 1: Make risk management part of daily operations

In many organisations, “risk management” still means an annual review, a long policy document, and a few risk registers tucked away on a shared drive. That approach won’t survive the next serious disruption, nor will it satisfy the kind of scrutiny coming from regulators, auditors, and global partners.

By 2026, risk management needs to be woven into everyday procurement work, not treated as a separate compliance exercise.

That starts with a clearer view of suppliers themselves. Teams need to know who their truly critical suppliers are, where Tier 2 and Tier 3 exposure sits, and which vendors carry higher financial, operational, or ESG risk. Licences, certifications, insurances, and key risk indicators need to be current and accessible, not scattered across filing cabinets and email threads.

Risk should also be visible event by event. When a major RFx is launched, risk considerations—dependency on a single provider, logistics resilience, cyber posture, ESG performance—should be reflected in the evaluation criteria and scoring, not bolted on at the end. Exceptions and waivers need documented rationale and approvals so they can be explained later.

Finally, risk needs to be monitored, not just assessed once. Regular supplier performance reviews should include leading indicators: on-time/in-full delivery, quality incidents, compliance breaches, and early signals that a supplier is struggling. When those indicators start to drift, the system should flag it so procurement and the business can act before it becomes a crisis.

A platform like ADAM-Procure makes this more than a one-off PowerPoint. Supplier data, RFx outcomes, contracts and performance signals all feed into one place, so the matrix can be refreshed on demand rather than once a year.

Priority 2: Elevate supplier ESG from compliance to education

ESG is moving from the “nice wording in the annual report” category into day-to-day procurement reality. Banks, listed entities and multinationals operating in Malaysia are already feeling this shift, and it will only intensify.

The organisations that are handling this well are treating ESG as a journey they take suppliers on, rather than a simple pass/fail gate.

They begin by being explicit about expectations. Codes of conduct, environmental and social standards, and governance requirements are explained clearly in onboarding materials and contracts, not buried in fine print. Suppliers understand what “good” looks like for that buyer.

They then segment their approach. Strategic and critical suppliers may go through deeper ESG assessments, joint improvement plans, and even co-investment in better practices. Mid-tier vendors might be engaged through webinars, guidance documents, and playbooks available in Bahasa and English, so expectations are accessible. Tail suppliers might be asked for lighter commitments and basic checks, with clear escalation paths for any red flags.

Critically, progress is measured. Procurement teams track what proportion of spend sits with ESG-screened vendors, how many critical suppliers have active ESG improvement plans, and whether the number of high-risk suppliers is shrinking over time.

This is where procurement shifts from being a cost centre to a value engine: using its buying power to help lift standards across Malaysia’s supplier base rather than simply excluding anyone who isn’t “there yet.”

ADAM-Procure supports this by embedding ESG attributes directly into vendor onboarding and recertification workflows, and by providing reporting on coverage and gaps at any point in time.

Priority 3: Move from activity to KPI-driven maturity

Another clear trend in Malaysia is that procurement leaders are increasingly judged on outcomes, not effort. Being “busy” is no longer the metric; delivering measured value is.

By 2026, a solid KPI framework for procurement in Malaysia should cover four main domains.

The first is efficiency and speed. Leaders need to know how long RFx events take from request to award, and how quickly PRs become approved POs. If cycle times are opaque, they cannot be improved.

The second is compliance and control. Key questions include: what percentage of spend is actually on contract? How often are POs raised after the invoice arrives, creating after-the-fact paperwork? How many audit findings relate to procurement and are those numbers improving?

The third area is supplier performance. Simple indicators such as on-time/in-full delivery rates, defect or return rates, and average resolution times for issues can tell a clear story about whether suppliers are supporting or undermining business performance.

The fourth is ESG and risk. Here, the focus is on the share of strategic suppliers that are ESG-screened, how many high-risk vendors are under active monitoring, and how frequently risk and ESG reviews take place.

A maturity ladder for Malaysia

You can think of procurement maturity as a five-step ladder.

At the bottom is “ad hoc”: email-driven work with limited policies and almost no visibility. One step up is “policy-driven”: documents exist, but enforcement is manual and patchy. The middle step is “digital”: basic tools and some dashboards are in place, but data quality and trust are mixed. Above that is “data-driven”: KPIs are reliable and used regularly in decision-making. At the top is “collaborative value engine”: procurement co-creates value with the business and suppliers, using data to shape strategy rather than just report history.

For many Malaysian organisations, the critical move in 2025–26 will be from policy-driven or basic digital operations into the data-driven zone. ADAM-Procure helps make that step by connecting vendor management, RFx processes and PR→PO workflows into a single traceable spine, so KPIs are grounded in real, consistent data.

Priority 4: Use technology to deliver transparency and trust

Malaysia’s procurement environment—public and private—is steadily moving towards higher expectations of fairness, transparency and robust appeal processes. Buyers are increasingly expected to show how suppliers were invited, how they were evaluated, what criteria were used, and who approved the final decisions.

Email threads, standalone spreadsheets and locally saved files are no longer sufficient when regulators come calling, internal audit tests a sample, an unsuccessful vendor questions fairness, or the board demands assurance that ESG and risk criteria were genuinely applied.

Tech-enabled transparency changes that dynamic.

In a digital RFx environment, criteria and weightings are defined upfront and captured in the system. Evaluations are recorded centrally, often with supplier identities masked during scoring to reduce bias. Final decisions are backed by clear scorecards, evaluator comments and logged approvals.

End-to-end traceability means vendor registration, RFx events, evaluations, awards, contracts and performance reviews are all linked. When someone needs to follow a transaction from PR to PO to GRN to invoice, the supporting documents and approvals are one or two clicks away.

Stakeholders benefit from visibility as well. Budget owners, finance and risk teams can see the status of sourcing events and contracts in real time. Red flags—such as single-bid tenders, repeated extensions, or missing approvals—can be monitored centrally rather than discovered after the fact.

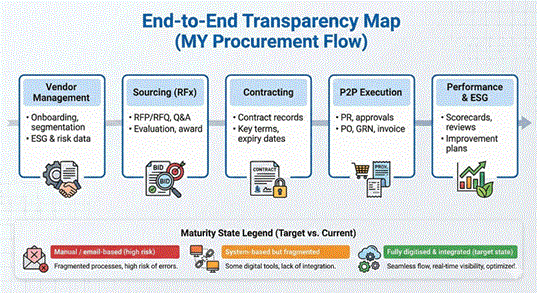

Mapping the Malaysian procurement flow

A useful way to think about this is as a left-to-right process:

- Vendor management at the front: onboarding, segmentation, ESG and risk data.

- Sourcing and RFx next: RFP/RFQ, Q&A, evaluation and award.

- Contracting: signed agreements, key terms and expiry dates.

- P2P execution: PR, approvals, PO, goods receipt and invoice.

- Performance and ESG at the end: scorecards, reviews and improvement plans.

Under each stage, you can classify your current state: which parts are still manual and email-based (and therefore high-risk), which are system-based but fragmented across tools, and which are fully digitised and integrated.

The practical goal for 2026 is to move as many elements as possible into the fully digitised and integrated category, with ADAM-Procure or a similar platform acting as the connecting tissue across the flow.

A 12–18 month roadmap for Malaysian organisations

This shift doesn’t have to be overwhelming. A realistic path for many Malaysian organisations between now and the end of 2026 involves three phases.

In Phase 1 (the first six months), the focus is on visibility and basic risk structure. That typically means consolidating vendor data into a single repository, mapping critical suppliers, and drafting a first version of the Risk vs Spend matrix. Basic ESG attributes can start to be captured during onboarding, even if the initial set is small. One or two important RFx events can be run through a digital platform with structured scoring to create early proof points.

By the end of this phase, leadership should have a simple maturity rating, an initial Malaysia-specific VM+RFx checklist, and visible wins around RFx transparency and cycle time.

Phase 2 (six to twelve months) is about embedding KPIs and transparency. Here, organisations define and agree on a KPI set spanning efficiency, compliance, performance and ESG. Digital RFx and PR→PO workflows are rolled out to key categories such as indirect spend, IT, marketing or logistics. Dashboards for CPO and CFO reporting are set up, so executives can see RFx cycle times, on- and off-contract spend, supplier performance trends and ESG coverage at a glance.

The outcome of this phase is regular performance reviews with business stakeholders, clear evidence that control has improved and manual work has reduced, and a stronger footing with internal audit and external partners.

Phase 3 (twelve to eighteen months) focuses on scaling ESG and collaborative supplier relationships. Suppliers are segmented and ESG engagement and education programmes are rolled out in stages—critical suppliers first, then mid-tier. Supplier scorecards are introduced with agreed KPIs, including ESG metrics where appropriate. Once data and governance are stable, AI-enabled use cases such as RFx drafting support or anomaly detection can be explored safely.

By the end of this journey, organisations should see clear improvement in ESG coverage, more proactive management of high-risk suppliers, and a stronger narrative linking procurement directly to resilience, sustainability and strategic growth. They will also be better positioned to meet the expectations of global partners and investors who increasingly assume this level of maturity as standard.

How ADAM-Procure supports the Malaysia 2026 playbook

Different organisations will take different routes, but there is a common requirement: a single, ERP-friendly platform that can support this kind of evolution without a multi-year overhaul.

That platform needs to host clean, structured vendor data with risk and ESG attributes; run transparent, auditable RFx events with criteria that reflect business realities; enforce PR→PO discipline while co-existing with existing finance systems; and provide layered KPI dashboards for operational teams, management and the board.

ADAM-Procure has been designed around these needs for mid-market and upper-mid organisations in Malaysia and the wider region. It provides the connective tissue for the processes described in this playbook, allowing teams to move faster and with more confidence.

👉 If you’d like to schedule a session, get in touch and we’ll find a time that works.

https://adam-procure.com/contact-us/

The shift is already underway. Malaysian CPOs are stepping into a bigger mandate, one built on visibility, accountability, and value creation. With the right foundations in place, procurement doesn’t just protect the bottom line; it helps grow the business.

See ADAM in action.

Get started and our friendly team will take care of the rest.

Explore how ADAM can transform your vendor management strategy today.